OBJECTIVE:

1. How to Identify next best product for the customer.

- Identify customer segments.

- Identify product purchase behavior and product affinity.

METHODOLOGY:

a)Business Understanding.

- Determine Business Objectives

- Assess Situation

- Determine Analysis Goals

- Initial Assessment of Tools and Techniques

- Translate into modeling objective

- Lay down Solution Framework.

- b) Data Preparation:

- List the fields that have been captured

- Data Selection, Transformation, and Integration

- Data Audit report as well as identifying variables that can be useful for the analysis

- Variable distributions, frequencies etc.

- c) Data profiling:

- Univariate Data Analysis: Univariate analysis is the form of analyzing data. Univariate analyze the data for each variable separately. Data is gathered from the source system for the purpose of answering a question on research on identifying the next best product for the customer.

- Bivariate Data Analysis: It is a data on one of two variables, where one variable is paired with the another variable. It would be to investigate the possibility of associations among the variables. The association is studied on a tabular/ graphical display, or via sample statistics which will be used for inference. The technique used to examine the relationship would depend on the level of extent of the variable.

- Categorical Variable Preprocessing: Categorical variables are basically the variables that are discrete and not continuous. For example color of an article is discrete variables however its price is a continuous variable. To study them, these variables may be arranged in a orderly manner.

- Data Transformation to create derived variable for modeling: Derived variables are created by calculating or categorizing variables that already exist in your data For case derivative variable may be an earnings Category which you will calculate for all of your participants by using a continuous variable Income.

- Variable Selection for modeling: Variable selection in regression is arguably the hardest part of model building. The very purpose of variable selection in regression method is to identify the best possible subset of predictors among the available variables to be included in a model.

- d) Validation:

- Listing of possible Action.

- e) Strategy:

- Suggest Strategy for improvement.

APPROACH:

- Understand Historical purchase behavior of the customer as: Frequency customer buying behavior, Monetary value of the transaction , Activity etc.)

- Segment identification (Demographic, POS purchase behavior etc.)

- Segment product affinity

- Customized campaign for Segments (Link MCC-Product hierarchy with vendor product catalogue)

- Action Insights (Rolling out the campaign).

- Run Campaigns

- Capture Customer financial behavior through Click or brick (branch transactions) for future analysis, which in turn help the bank to understand the historical financial behavior of the customer.

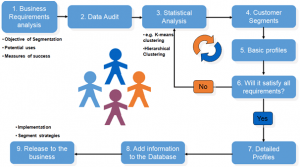

PROCESS OF SEGMENTATION:

- Business Requirements analysis (Objective of Segmentation, Potential uses, Measures of success).

- Data Audit : It is a process of conducting a data audit to assess how company’s data is fit for given purpose. This involves profiling the data and examining the impact of bad quality data on the organization’s performance.

- Statistical Analysis: Statistical analysis is a part of data analytics. The process of business intelligence, statistical analysis involves collecting and scrutinizing each and every available data sample in a set of items, so that desired samples can be drawn.

- Customer Segments :Customer segmentation is the process of dividing customers into groups based on common characteristics so companies can market to each group effectively and appropriately. In B2B marketing, a company might segment its customers according to the range of available factors.

- Basic profiling: It refers to the process of preparation and application of user profiles generated on the basis of data analysis (computerized). This is the use of algorithms or other mathematical techniques that allow the discovery of patterns or correlations in large quantities of data, aggregated in databases. When these patterns are used to identify OR represent people, they are called profiles.

- Will it satisfy all requirements, if no then again we will repeat the statistical analysis.

- Detailed Profiling: Detailed profiling is basically enhancing the company’s knowledge regarding their typical customers. All the process utilizes information to profile OR to illustrate the business’ consumers or target consumers. Profiling may be conducted on the segments or on its subsets.

- Add additional information to the Database to suit the customer requirements.

- Release to the business for Implementation and Segment strategies.

VARIABLES TO BE USED FOR ANALYSIS:

- a) Demographics:

- Age of the customer

- Marital Status of the customer

- Geography(Home branch of the customer will be taken as proxy)

- Occupation of the customer.

- b) Banking Transactions:

- Average Quarterly balance as on date.

- Vintage with the bank (based on account opening date)

- Depth of relationship (Product holding)

- c) Purchase Behavior:

- Frequency of transactions

- Activity Ratio

- Latency

- Recency

- Purchase amount.

- d) Other variable:

- Digital Savviness (Net banking usage, no of times INB/ MBS logins , Bill payment services, # Fund transfer facility used, enrollment for UPI )

- Life Stage.

- Lifetime value.

CUSTOMER PROFILING:

Its a way to create a portrait of customers in order to make appropriate business decisions concerning the segment

Customer profiling is process of behaviour relationship marketing technique which will include a range of marketing strategies ranging from simple one’s to complex one’s. Customer profiling starts with identification of relevant information regarding all the satisfied existing customers and then try to target new prospects with matching profiles. It’s away to create a portrait of customers in order to make appropriate business decisions concerning the segment.

- Frequency

- Monitory Value

- Latency

- Activity Ratio

- Product Holding

This will analyze the would be product gap (lead) in the customer profile. That particular product (lead) bank can pitch to the customer, which will increase the lead conversion of the bank and will bring customer delight.

Satish Kumar

Chief Manager (Faculty)

State Bank Institute of Learning and Development,

Deoghar.