….Connecting with the customers in banking sector

Social media marketing is a term that describes the marketing techniques focussed on various social medial platforms like, Facebook, Twitter, LinkedIn etc. Since its inception in 1996, social media has infiltrated more than half of the 7.8 billion (as on February 2021) people in the world. The users of social media have almost tripled during the last decade, from 970 million in 2010 to more than 3.81 billion in 2020.Information and communication technology has changed rapidly in the recent past, with a key development being the emergence of social media. The pace of change is accelerating. For example, the development of mobile technology and affordability of smart phones have played an essential role in shaping the impact of social media. All over the world, the maximum time spent online by an user is on mobile devices. Mobile phones provide an opportunity to connect anywhere, at any point of time on any device.

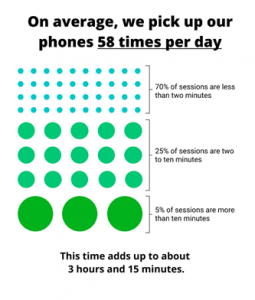

The time spent by us over digital devices is growing day by day. Studies show that American adults spent about 3 hours and 43 minutes a day using the mobile internet in 2020. This is expected to increase to over four hours in 2021. (Top smartphone users currently spend 4 hours and 30 minutes per day on those devices, according to RescueTime).RescueTime is a productivity software company that automatically tracks, without timers or any manual entry, the time one spent on apps, websites and any document. It has made an estimate of average phone usage of 3 hours and 15 minutes per day).

If we talk in Indian context, the average usage of smart phones has increased amid the COVID-19 pandemic, as people depend on these gadgets for work/study from home and entertainment. According to the study commissioned by handset maker Vivo and conducted by CMR (Cyber Media Research), the average time spent on smart phones in a day has increased by 11 percent. This time spent reached to the level of 5.5 hours in March 2020 (pre-COVID) from about 4.9 hours on average in 2019. This has further grown by 25 percent to 6.9 hours April onwards (post-COVID).

Whenever a person is using smart phone, s/he is often tempted to click on the social media apps and visit Facebook, Twitter, Instagram etc. These applications/ sites are the fastest and the most convenient ways to be connected to our loved ones no matter how far they are from us. These connections can help any person with a variety of things like seeking a new job, locating assistance, making or receiving advice etc.

Whether it is a non-profit organization, a business owner, a corporate giant, any public sector undertaking or even a government body, there’s no better way to present the message in front of millions of people by posting it online i.e. on a social media platform.

Marketing over social media platforms is now very common even for banks in this rapidly evolving business environment. These social media platforms are turning themselves from primarily social tools to build customer relationships and provide consumers with a personalized customer experience. Different platforms have matured and offer new ways to connect with people and communities.

Banks can use the social media marketing for information sharing, increase the intangible value in terms of customer loyalty and retention or advertising. Nowadays, banks are using social media platforms like Facebook, Instagram, Twitter etc. to offer help and support to the customers. Day by day, the social media is becoming a powerful marketing tool for brands and banks themselves. While banks, cooperatives and lenders engage and build relationships with consumers throughout the sale process, connecting with the customers really help the institutions to understand what is beneficial to customers and receive their feedbacks. Social media platforms can reach millions of people, increase brand awareness and foster relationships with customers.

While customers leave glowing reviews of companies they love, they also turn to social media to complain about policies they don’t like. This increases customer confidence, leading to better customer service and a more positive experience for the brand and its customers. Research shows that there is a strong correlation between customer satisfaction and the number of people using social media to interact with a brand.

However, it is important to develop and implement a social media strategy that puts the customer first. Creating an engaging, responsive and informative banking brand on social media can increase the consumer confidence and loyalty. Showing transparency, responding to feedback and listening to what consumers say on Twitter, Facebook and other social platforms is key to create more loyal customers. This also provides an opportunity to let potential customers have their say about your bank/ brand.

Listening to social media comments, compliments or complaints also helps banks monitor customers’ opinions about their brand and its competitors, enabling them to track, analyze and respond to customer needs, almost on a real time basis.

During the last decade, social media platforms have grown exponentially, becoming an integral part of our day today life, business and marketing strategies. People use these platforms to share photos, videos, opinions, rant about politics, discuss brands, expectations, experiences etc. Banks are now understanding and acknowledging the ability of social media to connect them directly with their customers. Social listening will provide banks with the information which can be crucial to maintain the customer loyalty.

Banks use social media to communicate with their customers, build credibility, launch new product offerings, showcase their corporate history and show what they have done and are doing in the context of social responsibility. In the everyday life banks are trying to get in touch with their customers on a personal level. For example, if a customer achieves a certain milestone in his life like getting a job or getting married, a bank can access that information and offer a product that would be in the customer’s best interest.

Generally, younger customers (say in the age bracket of 18-30 years) are not interested in going to a branch to talk to a representative and discuss investment opportunities. They prefer to manage their finances from anywhere, regardless of their location. Deepening partnerships with social media platforms will allow banks to offer financial services to customers from around the world, removing geographical constraints.

More and more banks are making social media a priority, looking for new ways to boost their followers, who are either their existing customers or potential leads. Social media has become an indispensable tool when it comes to brand marketing, and banks around the world are turning to it to accelerate brand promotion. It allows banks to connect with their audience and provide more efficient customer service.

Creating a Facebook page for a bank won’t bring in legion of new customers, but definitely impact your image in the digital world. People won’t start following the bank’s social accounts just because some XYZ company has created them. They will follow only when they find it useful to remain connected with those social media handles. Most companies have set up accounts with the Big Three- Facebook, Twitter and Instagram, and companies yet to set up an account, usually claim that social media doesn’t offer much value for their business. But the real picture is different. The creation of such accounts will be of value only when it is meaningful and responsive to customers’ needs and reactions.

Used correctly, social media can have a significant impact on the growth of any financial institutions. There is a tremendous opportunity for brands to influence the collective wisdom of the masses over social media platforms. This makes them able to build significant and defensible market positions based on firm social acceptance.

Pratyush Gautam,

Chief Manager (Faculty),

State Bank Institute of Learning and Development, Patna